Written by Eric Blake, Managing Director, ITG

Emerging markets are in fashion again, with equity fund inflows in 32 of the 36 weeks of 2017 through early September, according to EPFR. While investors have been enjoying positive returns this year from emerging markets, implementing an EM strategy always comes at a price. Whether it’s political turmoil and corruption in Brazil, mining strikes in Chile, regional security tensions in Asia or the impact of central bank rate cuts, managers and traders must keep a constant eye on events because the implementation of establishing an equity position can be costly.

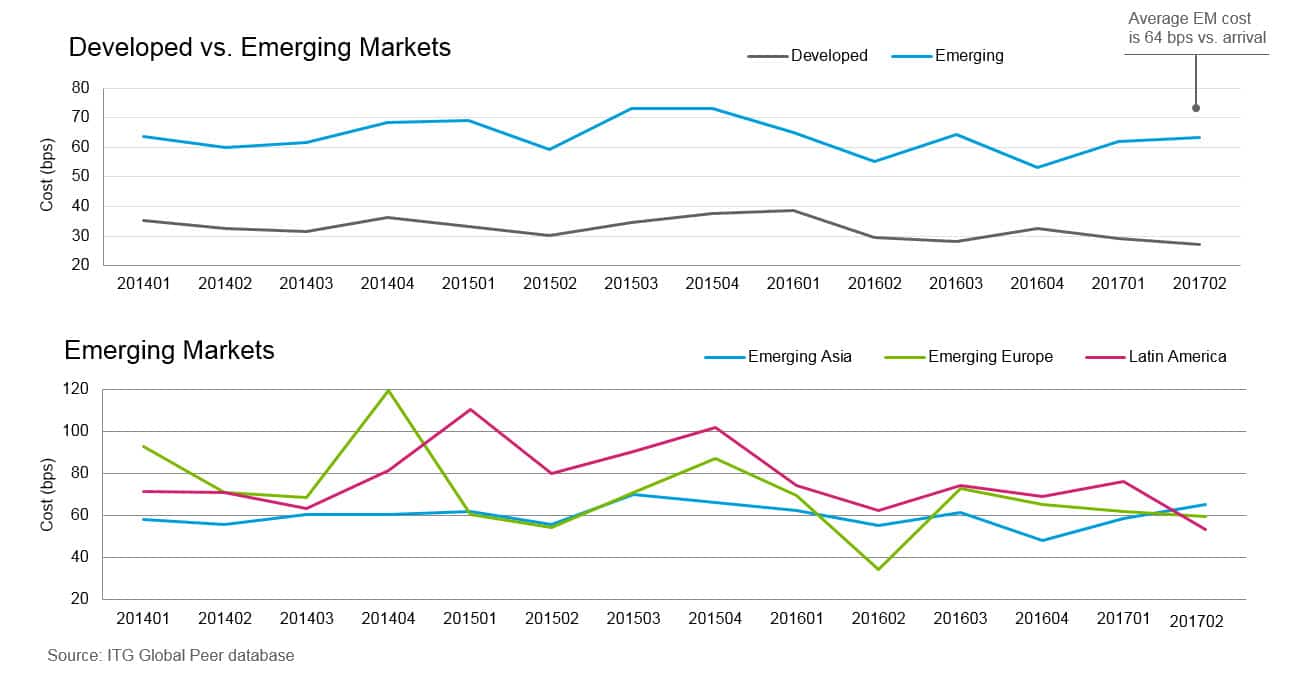

Concentrated trading volumes, wide stock spreads and market volatility are major driving forces behind the high implementation costs in emerging markets. ITG peer data shows that trading in emerging markets averages results in average implementation shortfall costs approximately twice as much as the average cost in developed markets. The equity inflows into emerging markets have pushed costs up, with the average trading costs in emerging markets up 16% to 64 basis points (bps) in 2Q17 versus 55 basis points in 2Q16. Of the three key EM regions, average trading costs are now highest in Emerging Asia (66 bps in 2Q17) followed by Emerging Europe (59 bps) and Latin America (54 bps). (Figure 1)

The Trend is Not Your Friend

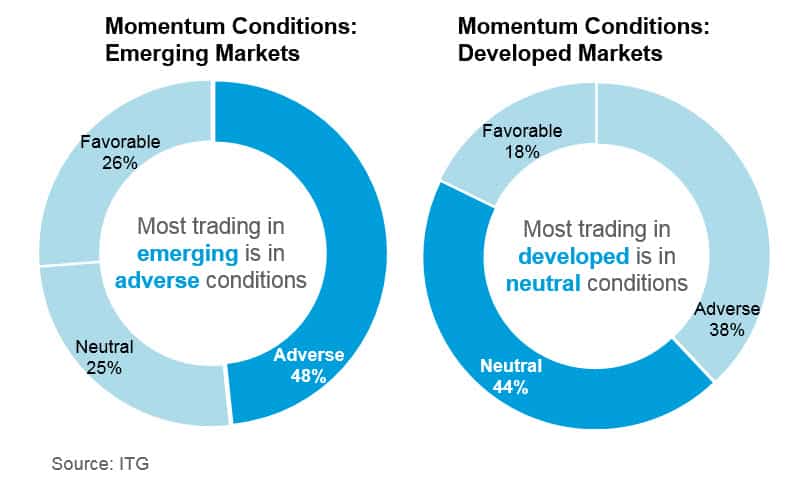

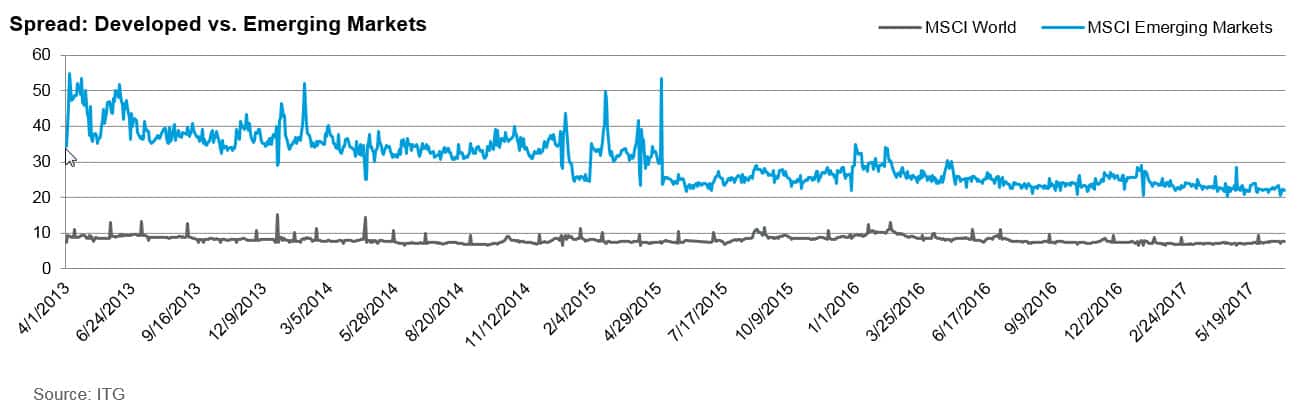

On average, trading conditions in emerging markets are less favorable in developed markets, with only 25% of trading taking place in neutral conditions compared to 44% in developed markets. Wider spreads also add to the challenge: emerging markets spreads are 6x wider on average as compared to the S&P 500. Given these factors, it is important to focus on trading strategies which minimize costs when prices are moving away from you, while being aware of how often your chosen EM trading strategy crosses the spread. (Figure 2)

Eyes on the Size

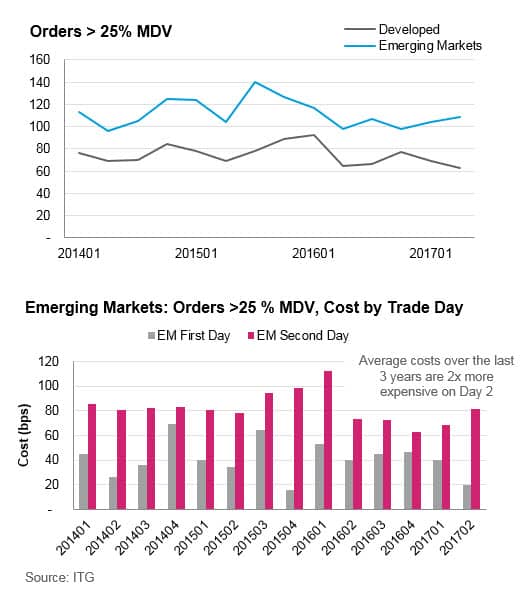

For institutional traders, finding liquidity in sufficient size can be a challenge. When comparing emerging markets and developed markets, the trading cost increase rises significantly for emerging market order sizes larger than 25% of marketable daily value traded (MDV). These block orders also have increased potential for information leakage, so having an implementation strategy that considers multi-day impact is important. ITG’s analysis found that orders larger than 25% of MDV were, on average, 41 bps more expensive to trade on day two compared to day one. Therefore, sourcing liquidity early, and with minimal impact, is critical. (Figure 3)

Risk and Reward

Emerging markets are among the best-performing asset classes this year despite the higher trading costs. Traders looking to put money to work in EM should choose strategies which minimize information leakage, factor in higher spread costs and the potential for higher volatility and adverse market conditions. Given these conditions, block trading platforms (including ITG’s POSIT Alert, which has seen EM spread reductions averaging 6 bps) and dark liquidity seeking algos are valuable tools for sourcing liquidity at lower cost and with narrower spreads.